WELCOME TO HAVENS

A warm welcome to something new.

Trump. America. Fracture. The disintegration of global order. The breakdown of institutions. Geopolitical chaos. Democracy in retreat. Trust plummeting. Pessimism soaring. Stagflation. Climate change. Crisis upon crisis. An age that feels like it’s coming undone. The world is now rupturing around us in dramatic, historic ways.

Welcome to Havens.

Hi. I’m Umair. Sometimes, I’m described as “one of the world’s leading thinkers.” I created Havens.

It’s a newsletter, which is a little different. Havens Members can follow along with its Model Portfolios, along with commentary, guidance, and updates, and more. They’re cutting-edge alternatives to standard investment portfolios, designed for a world of geopolitical turmoil, macroeconomic unravelling, financial fragility, and social upheaval.

I created Havens with love and care. It was originally made for my friends, family, and long-time readers, to keep them safe in a troubled world. I built it on cutting-edge research and thinking that’s probably the first of its kind in the world. And I designed it so they could use it flexibly and easily.

What’s in Havens has only previously been available by speaking with me one-on-one. Many have already been using its Model Portfolios and paradigms for some time now. I’m sharing Havens because for over a year now, as the world’s destabilized sharply, I’ve received many, many requests to do so.

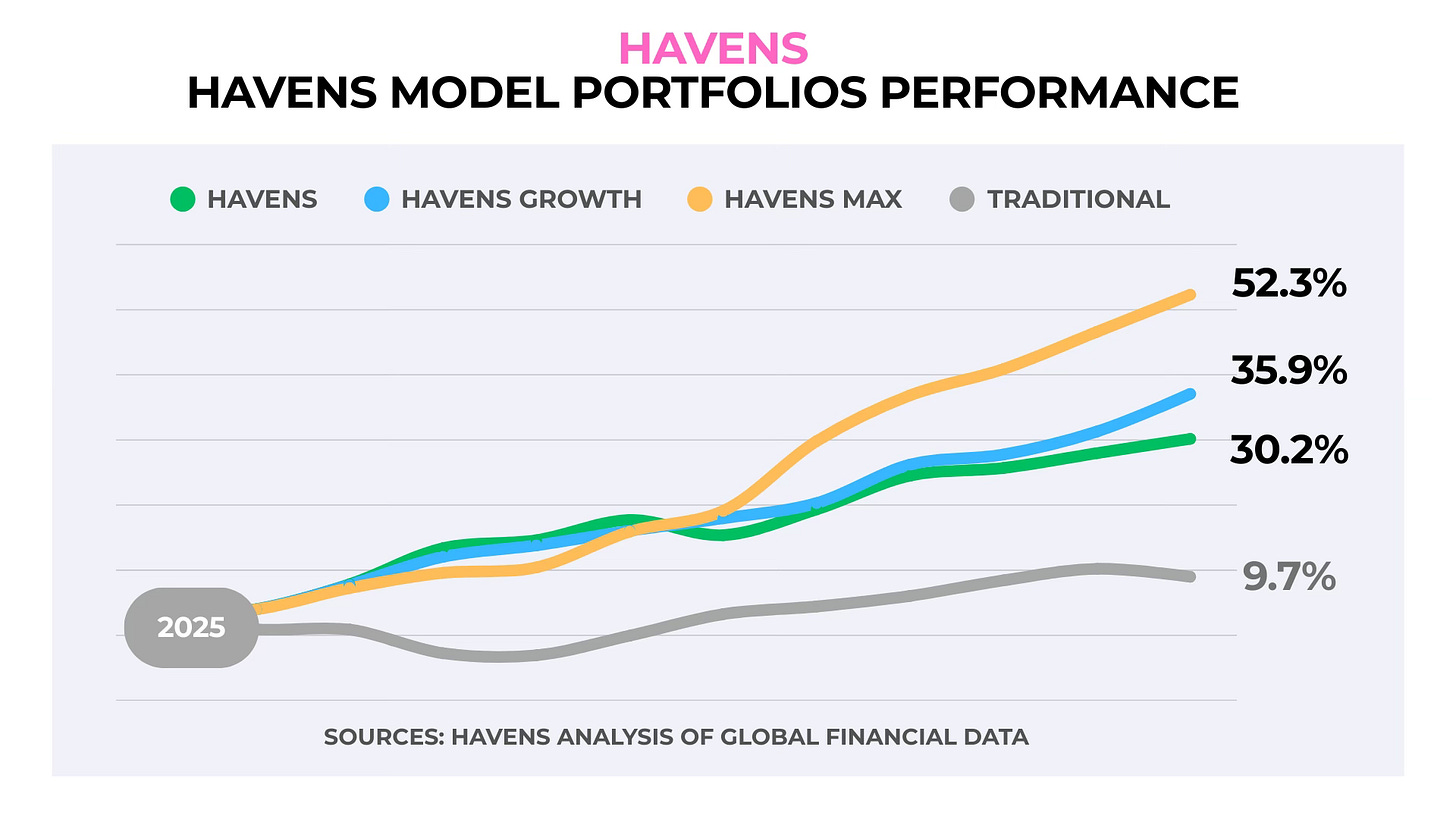

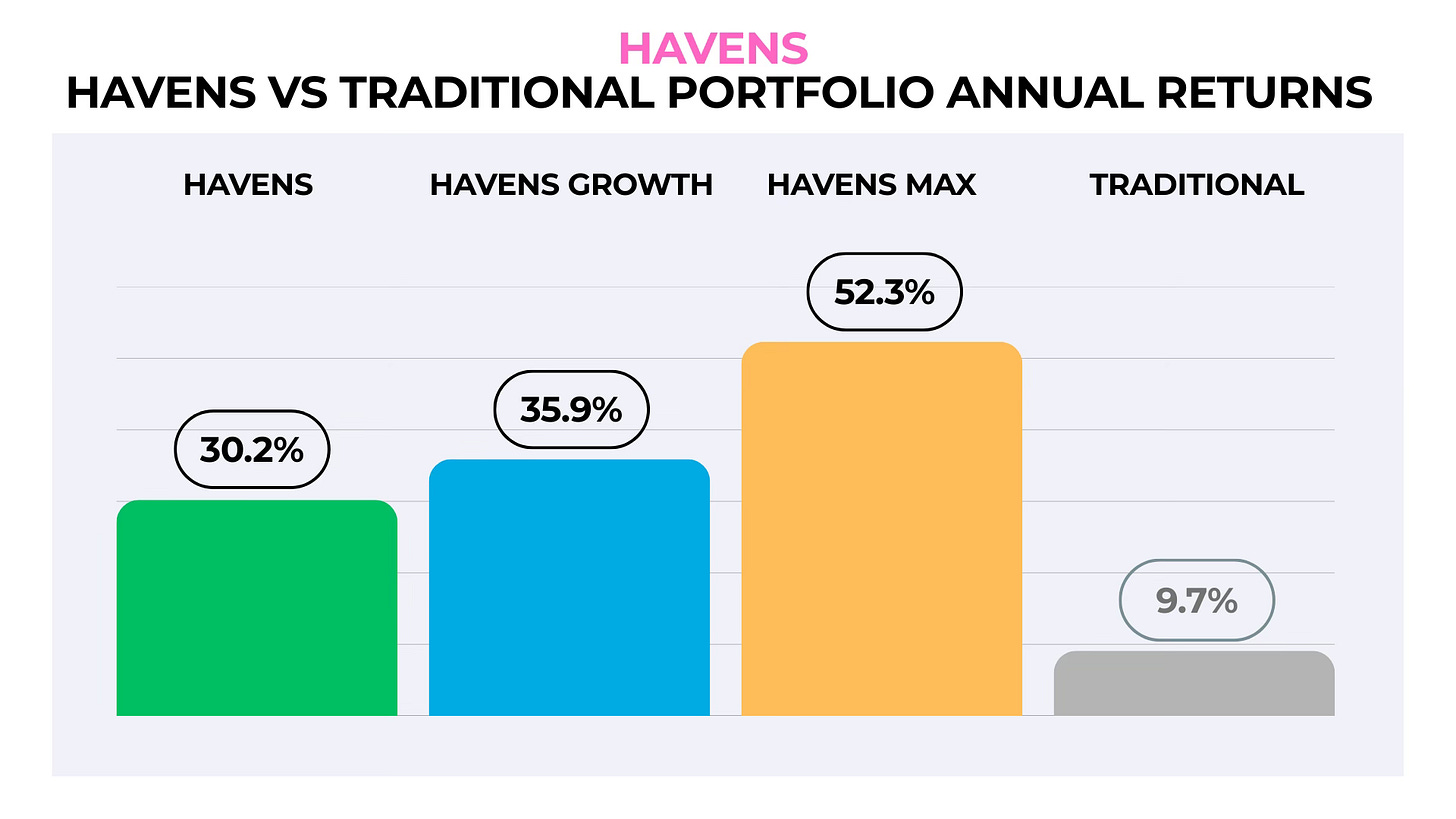

How’s it doing? I’ll let it speak for itself. Here, have a look. These are selected statistics comparing Havens to the traditional 60/40 US-based portfolio.

Afterwards, we’ll discuss what it means.

I created Havens so that my family, friends, and readers could have a cutting-edge alternative to the standard 60/40 portfolio.

Havens was built from the ground up for an unstable world, where macro risk is accelerating to severe levels.

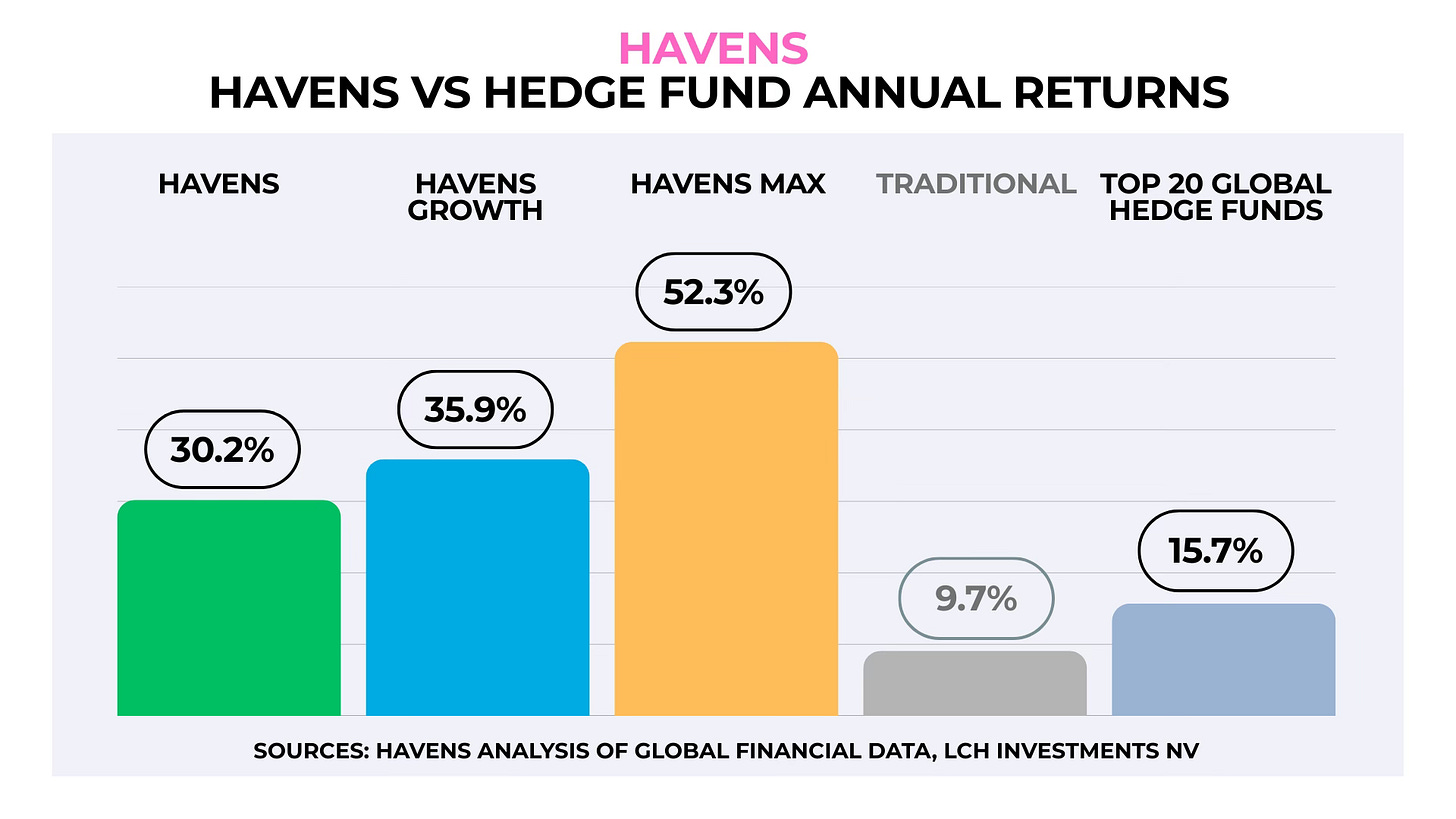

Let’s put that in context with an observation. The world’s top 20 hedge funds achieved an average return of 15.7% in 2025. Havens performs above those levels. So Havens’ returns put it among the world’s top investment funds. Go ahead and chuckle.

Havens is doing well. We’ll see if it continues to. It’s something new, in its early years. Like everything and everyone, the only thing to be certain about is that it’ll have bad years, too. For now, this is how I wanted and expected Havens to perform. I’m humbled to see it happen. Traditional portfolios aren’t doing as well, because they weren’t built for the age we find ourselves in now, and Havens was.

This isn’t a sales pitch. Havens doesn’t need one of those. It’s easy to see how powerful it is. I’m not sure if I should make it publicly available. This is all here to teach you.

The first lesson is: please don’t focus solely on the charts above. Returns aren’t how to think about finance and economics. I’m not promising or guaranteeing you’ll make thirty percent a year, and if someone does, like Bernie Madoff once did, run for the hills (go ahead and chuckle.) I often get asked if Havens “works,” and the answer is “yes, so far” but the point is deeper and truer. Havens is here to teach you about how the world is changing.

Havens, in that way, isn’t really just about or for “making money.” That’s just a byproduct of the Havens Thesis and the Havens Effect. I encourage you to read about them. I’m happy to see them borne out in such a striking way.

WHAT HAVENS IS (AND WHY I MADE IT)

WHY I CREATED HAVENS

Like I said, I created Havens with love and care, for my friends, family, and fans. Over the last decade, as my predictions about more or less every major global event came true, from Trump’s first election, to his re-election, to American collapse and the disintegration of global order, my friends, family and fans often began reorienting their decisions around my counsel. They made Plan B’s, moved, set up new lives, and did well financially, too.

So I made Havens for people I cared about, and I designed it so they could learn from it and use it. Many of them felt failed by traditional approaches. Part of the point of Havens was to give people a financial alternative that doesn’t kind of suck, morally, intellectually, and practically. But only part of it. Havens is here so I can use it to teach you how to think about the world in the 21st century, why it’s unravelling, what it means, and what the future holds.

HOW HAVENS WORKS

At Havens, you keep control of your wealth. Havens doesn’t see or touch your money. Instead, using the Model Portfolios, you can create your own instances, follow along with updates, tweak them, and “Havenize” your own wealth to whatever degree you wish. So Havens isn’t a traditional fund that manages money, nor is this a sales pitch for one (it’s here to teach you.)

Simple and easy to use means that Havens is based on a classical “buy and. hold” approach, using everyday stuff. It doesn’t use complex strategies, exotic and arcane financial products, or employ a million trades a day. You don’t need to open a bank account in some sunlit foreign destination. I designed it this way so that everyone who wanted to could build their own Havens portfolio with readily and widely available assets.

Flexible means that should you want to, you can build your own Havens portfolio in many ways—even with something as simple as an online account, in a day, or even an hour. You can also use it together with your financial advisor, your finance team, your family office, your banker, whomever you choose.

WHAT HAVENS IS

Havens isn’t just different in how it works. It’s also based a new and different paradigm. Havens Thinking is very different from most models of economics and finance (which I think are growing increasingly obsolete.) It’s built from the ground up on what’s probably the world’s first Index of Civilizational Risk. The Index synthesizes many of the world’s largest-scale datasets, took several years to develop, and tells us where we are as a civilization. (You can see it and read more about it in The Havens Thesis.) That’s how Havens was made for a troubled world. Most financial stuff wasn’t, and so it’s growing obsolete now.

All that’s a long way of saying: Havens does a much better job of hedging against the tectonic shocks now shaking our world than traditional portfolios do. At Havens, we call these Macro Risks, and they’re now so severe that old approaches can’t contain or manage them well. Havens does, because it was designed to, and because of that, it performs very differently, too.

Those more proficient with finance and economics can think of Havens as a virtual hedge fund, hedging against the Macro Risk Events shaking our world. It performs at or above that level because that’s how I designed it (and yes, I’ve spent time at hedge funds, as well as having been a chief economist, etcetera.)

You can also just think of Havens the way my friends do, dude, the world is unravelling, please, you’re supposed to the Giant Brain, idiot, so give me something that helps and I don’t have to stress over all the time. Dammit, I already hated finance, and that was before the world was ending.

WELCOME TO HAVENS

That’s a lot to take in.

In all these ways, Havens is new and different. Be gentle with it. Explore it and learn from it. It’s here to teach you about finance, macroeconomics, and geopolitics in a dramatically changing world. You can now understand how deep the thinking in it goes. It took me several years to create, by the way.

Like I said, I’m a little reluctant to share Havens. I question if it should exist at all, beyond my one-on-ones. Whether it’ll be used wisely or well. The truth (if you really want to know it) is that Havens makes me sort of depressed (I know, that’s funny. I think it’s because I like art, writing, science, music, and things that change the world, not just money.) And I don’t know if the idea of a model-hedge-fund-you-can-subscribe-to can work. It’s genuinely something new.

If I don’t like the way people use it, I might just end it. Nobody’s entitled to Havens, not even me (even I treat the Models and Portfolios very carefully and gently.) We’ll try it for a while as an experiment. I want to be upfront about that.

Havens isn’t for everyone.

I created Havens for intelligent, thoughtful, nice, kind, and cool people. If you have a favorite poet, old dusty book, scientist, artist, idea, philosopher, then Havens might be for you. Angry Grandmas, disillusioned liberals, tired Gen-X’ers, frowning Millennials, weary moral souls, former punks and old school goths, everyone who’s a Robert Smith or Freddie Mercury or Albert Camus or Miles Davis fan, Good Samaritans, avid book club goers, all the kids who used to hang out at the library at midnight, everyone who’s ever fallen in true love, welcome.

But if you admire dictators, or you think science and fascism are “debatable,” if you secretly burn with resentment at women and/or minorities, or if you just want to make a quick buck, then you should probably step away now.

So. All that’s how I made Havens with love and care. As a new thing, a new approach, a new paradigm, in a world that’s falling apart. It’s not just a “product.” If you treat it like one, I’ll probably just ignore you. If you act entitled to Gigantic Percentage Returns, I’ll side-eye you. I always tell my friends that I have to look after them. We all have to look after each other now. This was the feeling and motivation behind Havens.

If it sounds like it’s for you, you are most welcome.

Thank you for reading.

Love,

Umair (and Snowy!)

Havens isn’t financial advice. Havens and its model portfolios are provided for educational and informational purposes only and are subject to change. Havens and its model portfolios are not recommendations or solicitations to buy or sell any security or financial product, or to employ any trading strategy. All model portfolio results are hypothetical. Actual performance may differ from hypothetical performance for a number of reasons, from timing, conditions, restrictions, taxes, and expenses.