THE HAVENS EFFECT

Where an unravelling world is going, and why.

The Havens Thesis says: as Civilizational Risk accelerates, there will be a flight towards Havens. Is the thesis true or false?

Now we’re going to talk about what Havens is really about. Civilization. History. The future. Us. How our world is changing, and how it will now be oriented around Havens, of all kinds.

I call that the Havens Effect.

The Havens Effect is already dramatically reshaping macroeconomics and geopolitics, prosperity and power, the rise and fall of nations and axes. It’s likely to define much of the rest of this century, because our macro trends as a world are pointing in the wrong directions.

So the Havens Effect isn’t theoretical. It’s vivid proof that the Havens Thesis is real, and it’s now rapidly transforming our world. Let me formally show it to you.

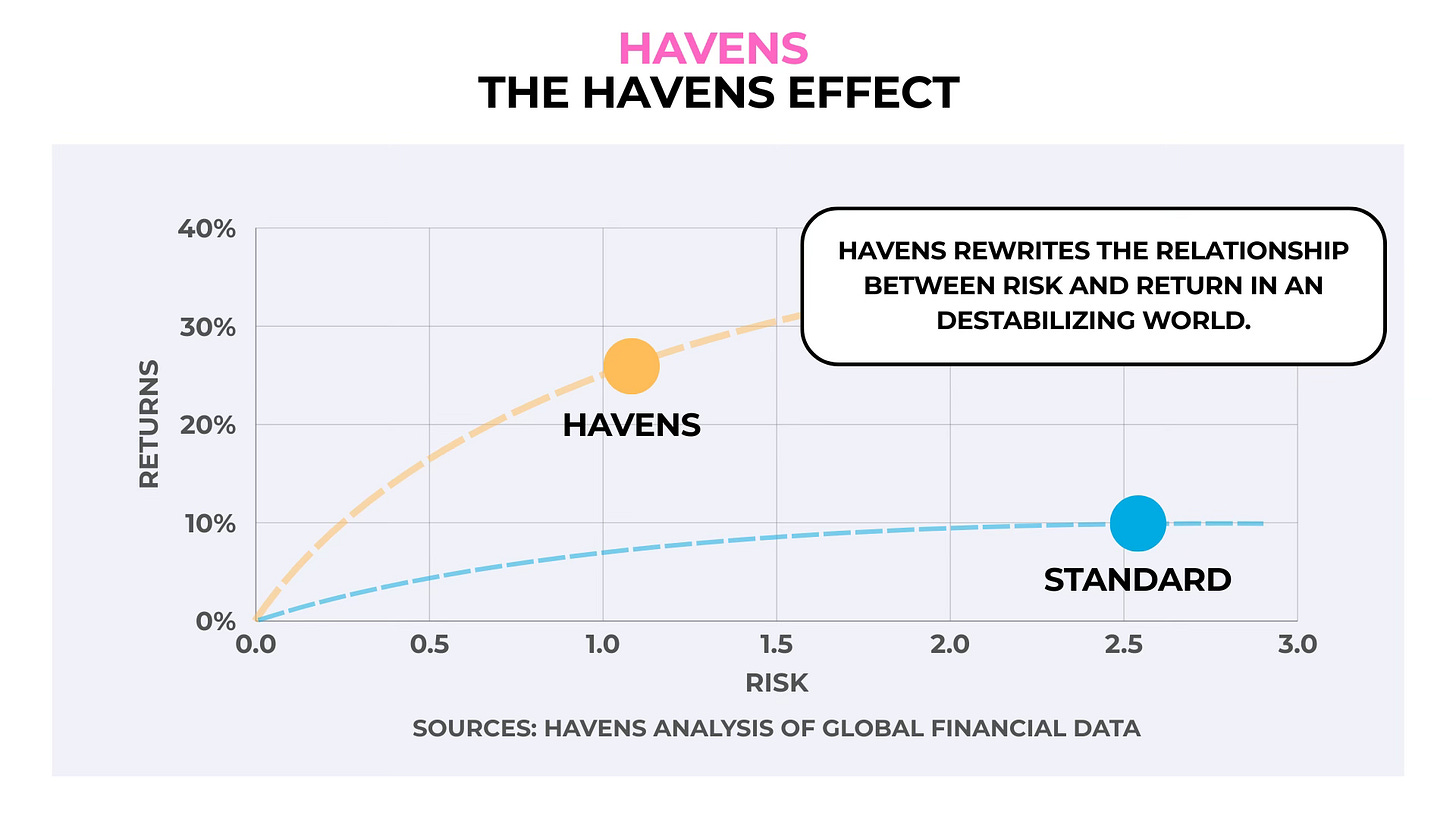

See how Havens literally operates at a higher curve, or frontier? In finance, we call the optimal relationship between risk and return the “efficient frontier”: returns for risk. Think of it as a boundary for wealth. Look at the chart above: the blue line is the boundary, or “efficient frontier,” of the traditional portfolio. Now look at Havens. It is operating at a new frontier. We’ll see if it continues to.

Think: how much risk do you take—and how many returns are you going to earn—by holding assets trapped under Trump’s thumb, for example? This was what I designed Havens for, to test if we could rewrite the relationship between risk and return.

What the above shows us is that so far, we can. That’s the Havens Effect at work, in the real world. It’s proof that the Havens Thesis is working, so far. (And for the social scientist in me, it’s deeply interesting to see.)

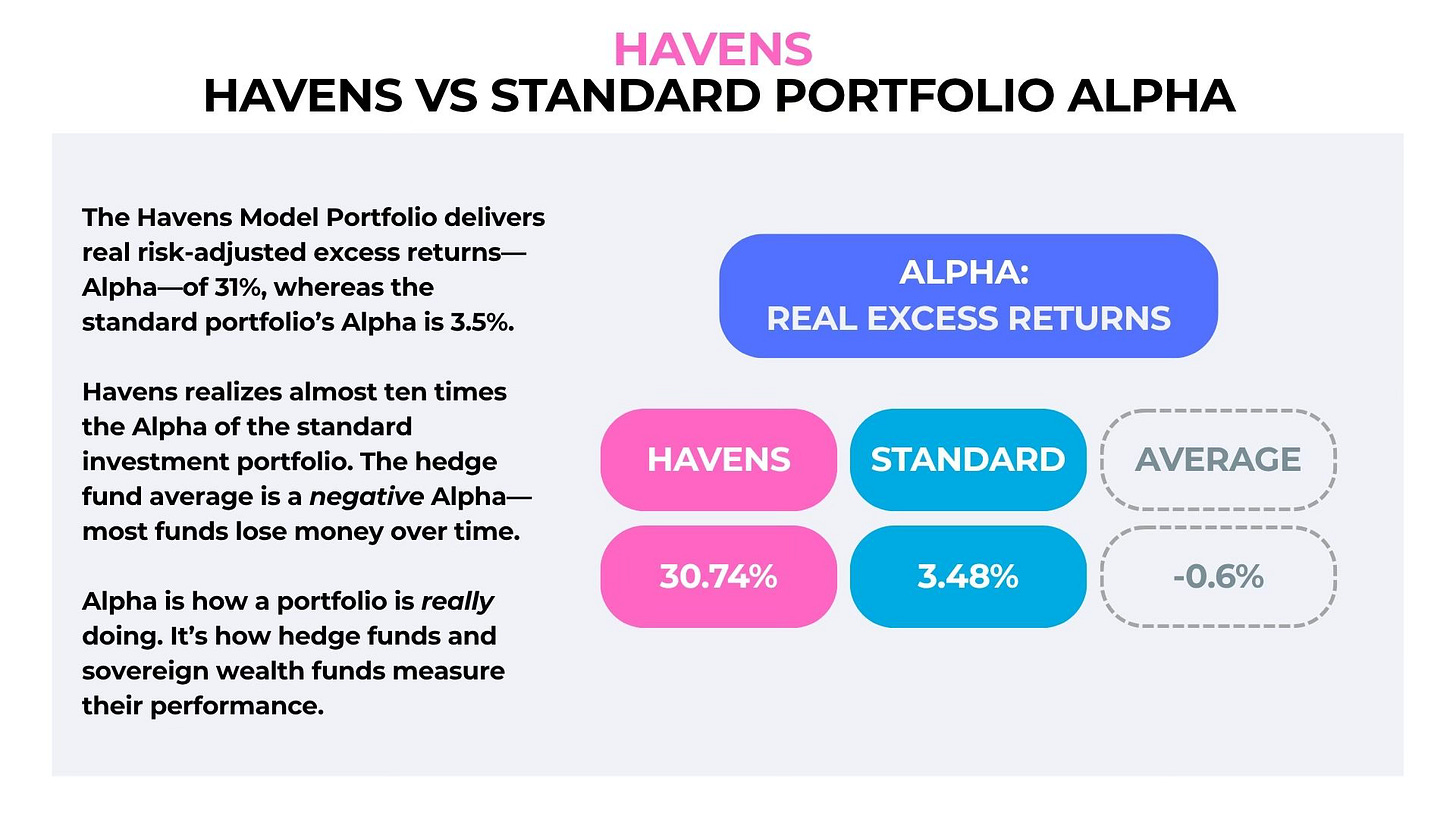

Here’s another way to quantify the Havens Effect. When we evaluate the performance of investments, we should always look at a number called “Alpha.” It represents real risk-adjusted excess returns, which is a long way of saying “how much over and above the market a specific fund or strategy earns.”

Havens has an Alpha of 30%—real, risk-adjusted excess returns, over and above the market. That’s on par with the world’s top performing investments. The standard 60/40 portfolio’s Alpha is 3.5%.

These two charts are pretty nerdy. Nobody likes math, so let me make them clearer. What they show is simple: you can see the Havens Effect at work. At the largest of scales, which is civilizational. As our civilization is at this historic turning point, there’s a dramatic flight towards Havens. Whether or not it continues is something we’ll see about. For now, though, there’s a clearly observable Havens Effect, and it’s striking.

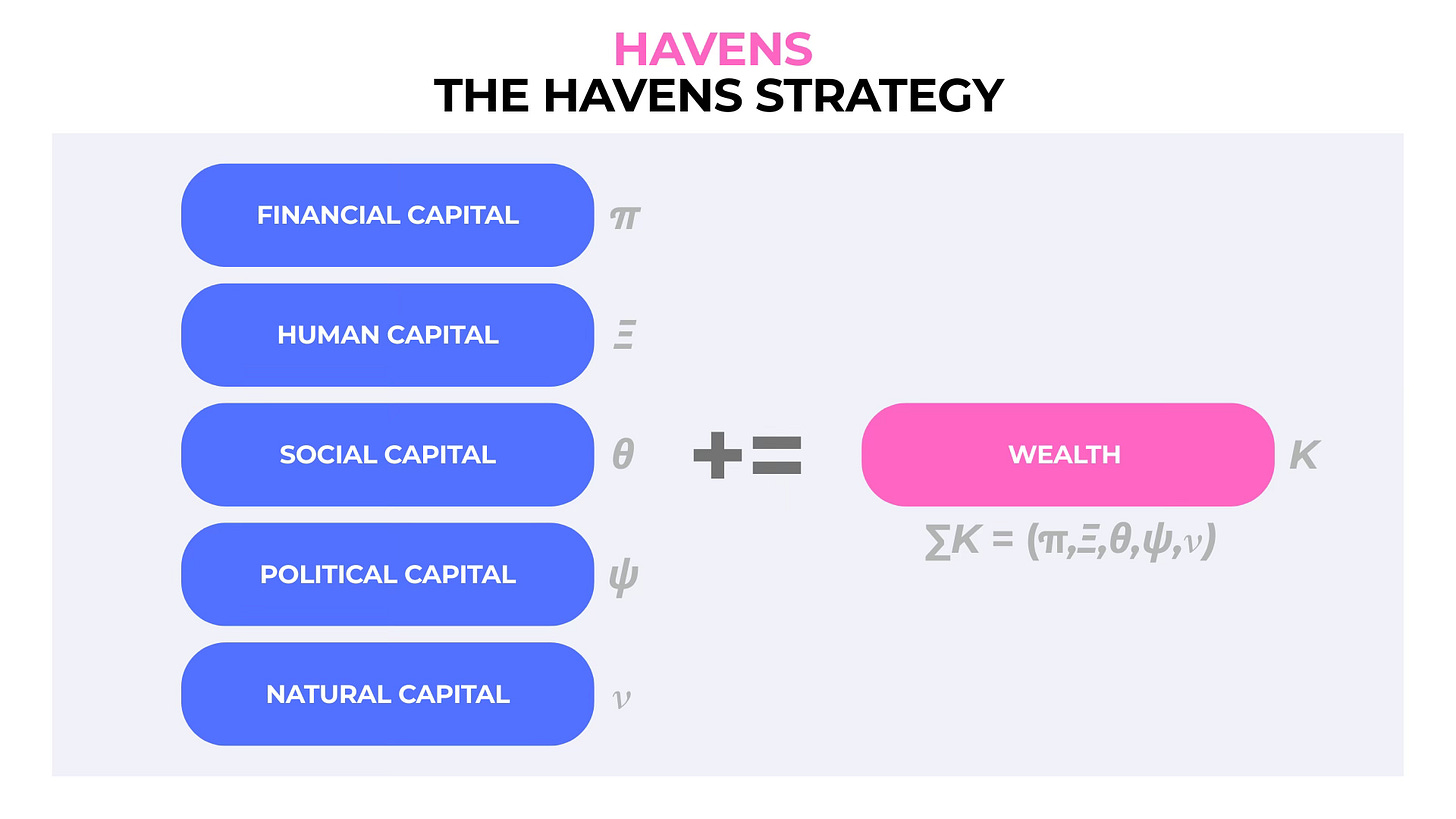

So Havens isn’t really just about your stock portfolio or mine at all. It’s about how wealth, which is human possibility, is created and grown at the macro scale. Havens in this way is really about how human organizations, whether companies, institutions, countries, worlds, or civilizations, create or destroy, squander or grow, their real wealth, which isn’t just financial, but comes in many forms (think of how Trump has shredded America’s reputation, institutions, and democracy, for example.)

Remember the boundary above? We can think of what boundary of wealth a nation’s operating at. An era. A world. A troubled one, like ours. Or even a civilization.

And we can then use it to understand and shape the economics of all those, even, in turn, creating Havens.

That’s really what I created Havens for—not just “making money,” but trying to fundamentally deepen our understanding of civilizations and how they rise or fall, in an age as troubled as this, so we can begin to fix things as a world, instead of spiraling into the abyss like America.

Havens is about a new frontier, and now you can see that when I say this, I mean it in a thoughtful way.

WEALTH IN THE 21ST CENTURY AND HAVENS

So how does Havens cross the old frontier? In Havens, we aren’t looking for “companies” or even “assets.” That is the old way of thinking. Havens Thinking is very different. We don’t just look for “money making money for the sake of money.” At Havens, that is the biggest red flag of all. We look for higher levels of more powerful kinds of capital. These are “Havens”—the real things.

Think of company that makes a lot of “money,” but treats its people poorly, has no compelling vision for the future, is saddled with debt to buy back its own shares, and whose board lets all this go on. Or think of a country with similar dynamics. All of those are forms of capital which are not being utilized well, and so are atrophying. Such a company, such a country, such a system would be a poor investment. Today, America would be an example of such a system.

Now think of a well-managed company or country. It’s humming with relationships, from which new ideas form. Those ideas collide into greater breakthroughs. It isn’t just thinking of the short-term, because it’s thinking clearly in the first place, with a strong vision for the future. Its people feel valued, and for that reason, make wiser decisions. A strong sense of purpose is present, and knowledge, truth, intellect, and creativity are treasured. Those are all forms of capital, being used to generate real wealth over time.

In formal terms, Havens looks for what I call “higher order capital intensity.”That sounds complicated. But as a result, Havens is simple. It has just a few components in it, that are held for the long term, because they aren’t volatile. They aren’t fragile, because they aren’t based on predation. They’re harder to contaminate, because they’re purer. In Havens, the strategy is longevity, simplicity, and purity over speculation, predation, and volatility.

In plainer English, as the world destabilizes, there’s a flight to Havens, which are systems and structures that preserve civilizational wealth. Conversely, civilizational risk ultimately disintegrates wealth into lower and lower forms, until little is left. Think of how Trump’s shattering America, and it’ll snap into focus.

All this is meant to show you that the Havens Effect is very real. And even to show you what many people have asked for, a formal representation of the models I use to predict and understand the world and where it’s going. It’s a lot to take in, but I hope this helps you understand the thinking behind Havens.

I’m happy to see Havens does what I designed it for. It begins to rewrite the old relationship between risk and return. I’m struck by how well it does it currently, too. That is why I spent several years developing the concepts in it, and building the Civilizational Risk Index.

Love,

Umair (and Snowy!)