Why Everyone But Economists Knows the Economy Sucks

Why the Numbers Understate How Much Economic Pain People Are Really In — And Why It Matters

We’re at one of those strange moments. Another one. I’d sum it up like this. Everyone but economists think the economy sucks.

Ask an economist, and you’ll get an answer a little bit like this: “Things aren’t so bad! They’re getting better! Inflation’s falling! See — look. What are you people so upset about?”

Meanwhile, ask the average person, and they’re incredibly pessimistic.

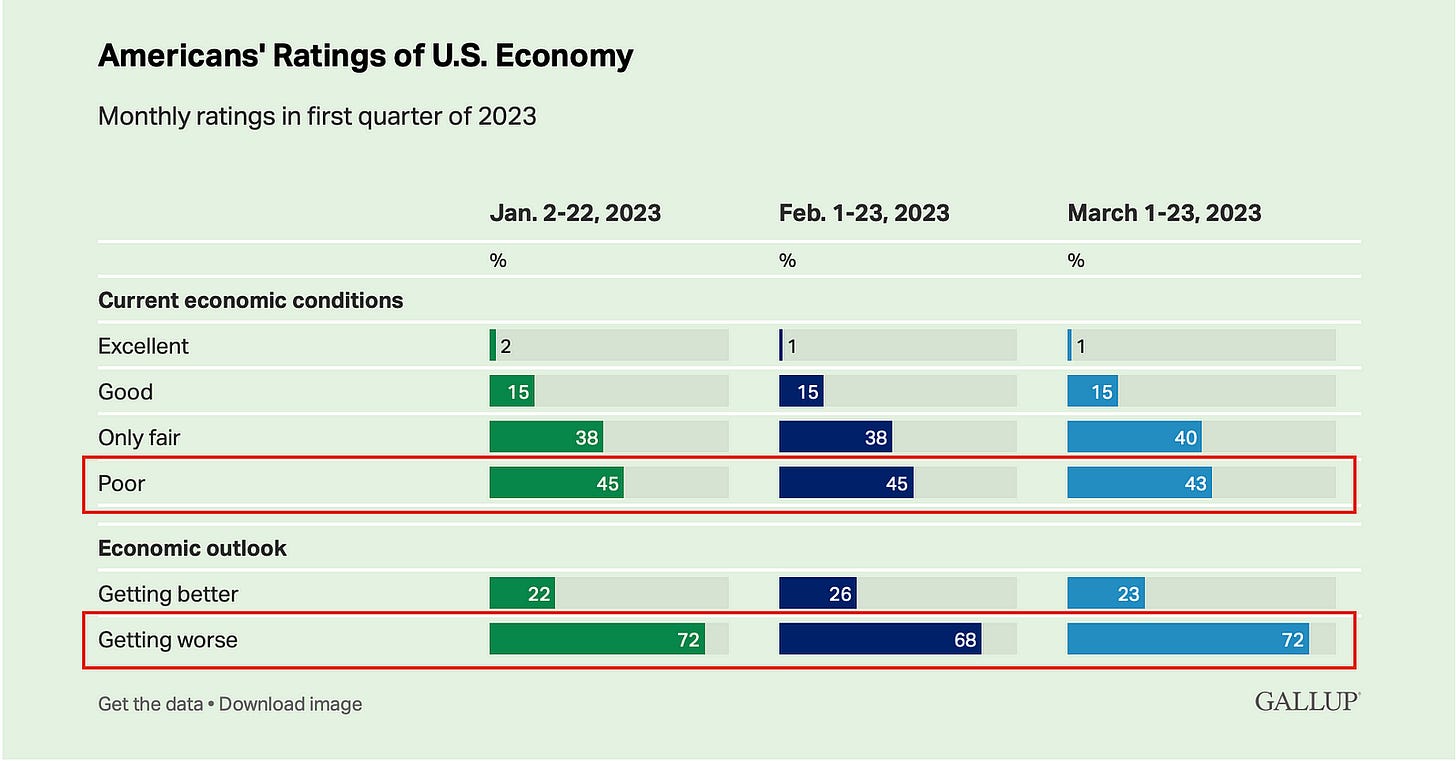

The American public continues to rate the U.S. economy in mostly negative terms in March, with 83% describing current economic conditions as “only fair” or “poor.” Just 16% consider them “excellent” or “good.” Furthermore, 72% think conditions are getting worse, while 23% say they are improving.

Why the disconnect? Ask the economist again, and they’d probably tell you that people are overreacting, suffering a hangover from the last couple of years, that it’ll take them some time to catch up, emotionally, to economic reality. But is that really true? Or do people have a point here that economists — and politicians — aren’t really hearing?

There’s a wrinkle in this story my fellow economists are telling — three, to be precise. That narrative is now what it so often is. Everything’s going back to normal. Nothing to worry about here. And the main line of evidence used to support it is inflation — beginning to fall. It’s now around 5% — that’s not so bad, is it?

And yet people clearly don’t feel as if inflation’s falling very much. So what gives?

There’s inflation — and there’s inflation. What’s happening is that economists are often looking at “core CPI” — but that, crucially, excludes food and energy. LOL. Food and energy. You know, the basics. When we look at broader measures of inflation — that don’t exclude the necessities — a very different pattern emerges. One that’s much more dire, in fact. And explains why people are so pessimistic.

That pattern looks like this. Prices are beginning to fall in some ways. But when it comes to the basics, the necessiities? Prices are still skyrocketing. Fast. Hard. Let me give you two examples.

Food? It’s not rising at 5%. Its inflation rate is still 10%. Then there’s shelter. It’s not “disinflating” — it’s rising in a straight line. Not at 5%, but 8%.

Now. An economist might look at these numbers, and make a big mistake. Average them. Against each other, and against other kinds of goods in the economy. But a person doesn’t think that way, because their household finances don’t work like that. When the price of food is rising by 10%, and the price of shelter is rising by 8%, suddenly, in real terms, you’re almost 20% worse off than you were a year ago.

Let me make that point really, really clear. Economists average, but people have to add. Add up all these costs. An economist can look at inflation rates across different kinds of goods, average them, to arrive at a figure of 5%, and say — why, that’s not so bad! What are people so worried about? They are making a category error. People’s finances don’t work like that. When you have to pay 10% more for food, and then another 10% more for shelter, you’re not averaging. Those costs are additive. You are 20% worse off — and it feels, now, as if you’re balanced on a knife edge.

This is exactly we see very real danger signals pulsing through the economy. Personal debt levels are soaring. People are using buy now, pay later schemes for…necessities. Delinquencies are beginning to rise. People are struggling to bear all these costs. And economists are not really doing a good of understanding what the economy is actually like for most people.

People aren’t experiencing anywhere near a 5% inflation rate. If they were, they’d breathe a massive sigh of relief. Instead, they’re experiencing runaway inflation, at life-shattering rates. 10% more for this basic, 10% more for that one. It all adds up pretty fast, and before you know it? You feel poor, even if you’re making what used to be considered a pretty healthy income. So how much worse is it for people right at the average? Or below it? That’s half of society. How are they affording double-digit rises for multiple kinds of basics?

When you’re paying 10% more for this kind of basic, and then 10% more for that one — it’s cold comfort to hear someone say, “but so what! Look, at least the price of this kind of thing — clothes!! — is only rising by just 3%. So on average, it’s not so bad!” You’re not averaging. You’re trying to make ends meet, and those costs add up.

And incomes that aren’t rising anywhere near as fast. Know anyone that’s gotten a 20% raise in the last year? That’s going to get another 20% this year? I didn’t think so. Nobody’s income is rising fast enough to keep with what the reality of inflation is experienced as — not just averaged away as.

Let me make that even more concrete. What other forms of inflation don’t these “core” numbers — which first exclude necessities like food and energy, and then, even when and if they include them, average them away, which creates a statistical illusion, because, well, the price of luxuries rising more slowly is cold comfort when you’re skipping meals to make ends meet, which 39% of Americans now say they’ve done to be able to make house payments?

Consider what you might call the Feeconomy. It’s now the subject of jokes. Go to a hotel, and there are “resort fees,” even if, LOL, it’s just a bland corporate hotel in the sticks, or worse. Order some food, and — Jesus, why does my pizza cost $50? — the fees are more than the food. The fees become more absurd by the day. “Convenience fee,” “processing fee,” “order fee,” “inactivity fee,” “administrative fee,” fees for paying the fees. How much do those add up to?

The answer to that question is: a hell of a lot. We know that, because corporate profits are at their highest pointin…history…ever. That’s not because people are happy to pay a fair price to get a great deal. It’s because corporations have learned to add these absurd fees to everything, in increasingly exploitative yet unavoidable ways. They did that as a form of risk-shifting: the fees effectively become a fixed cost that consumers have to pay. When Covid was snarling supply chains, this made a lot of sense — for corporations. It passed risk on to people — there’s the variable cost, the food, hotel room, whatever, and then the fixed one: the fees. Double whammy. That tactic has worked incredibly well, because now, like I said, corporate profits have skyrocketed to their highest point in history.

Keep reading with a 7-day free trial

Subscribe to HAVENS to keep reading this post and get 7 days of free access to the full post archives.