What Does America’s Future Look Like?

Why America’s National Debt (Really) Matters, and What It Means

Today we’re going to discuss America’s…future. What does it look like? Is there much of one — given the profound pessimism most Americans feel? The lessons, too, apply to many countries — so think about your own if you’re not American.

Lately, the national debt’s been a big story in America. The Democrats and Republicans finally hammered out a deal, and so America won’t…default. That’s better than nothing, but the deal also means a lot of pretty bad things, like student debt gets reactivated, etcetera. Why does this matter? Economics shapes the future of nations, like it or not. And America’s? It’s a story of colossal fiscal mismanagement, which is…well, let me explain. This dry subject of public finances, which, actually, is one of the world’s great untold stories.

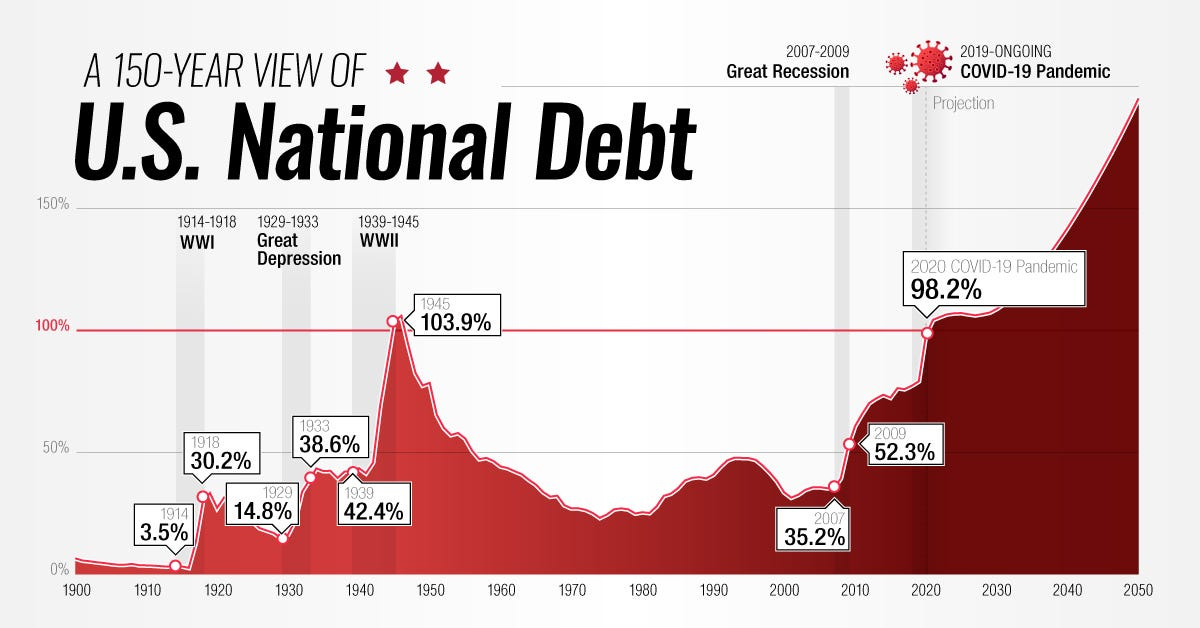

How did America’s debt get so high? It recently crossed about 100% of GDP, which is usually a danger signal, a red zone, the point at which financial markets pull back. It’s less of a big deal for America, because of course it’s still the world’s richest country, even though people are effectively poor, it holds the reserve currency, etcetera. But it’s still a Big Deal, make no mistake. Why? Well, let’s go back to the question.

America’s debt got this high for a handful of reasons, and you can see them literally on the chart, if you just think about recent history. Wars cost it a pretty penny — and I’m not making a political or moral judgment like “war is bad,” I’m just observing the reality of the cost. Tax cuts incurred a huge cost too — you can see the literal cliff edge of the Trump era tax cuts. Then there were bank bailouts. And finally Covid, which was worldwide, and for now, we can kind of disregard it. But in short: war, tax cuts, and bailouts. Just a few decades of them — because you can also see that until 2000 or so, America was doing OK in terms of debt and deficits. But a few decades of such decisions? And bang — you’re at a massive, massive national debt.

Now. What does all that mean?

Well, to understand that, we have to put it in perceptive. To do that, let’s look at Europe. There, too, in many countries, debt is a becoming a problem. France recently hit around the same threshold as America, and that’s why Macron felt he had to raise the retirement age, which was so controversial that protests erupted for months. Spain, Italy, and so on. Debt is a worldwide problem, with a few notable exceptions, who we’ll come back to — Canada, Germany.

So Europe and America have around the same debt loads, and I use the word Europe loosely there. But there’s a big difference.

Europe amassed that debt…in a very different way. What do Europeans enjoy today? Expansive social contracts which are world-renowned. Everything from high-speed rail to universal healthcare to affordable education for all, right down to good public media and so on. My favorite example is Harvard (or any Ivy League) costing an eye-watering amount, twice the median income or more, per year…while the Sorbonne…is…free.

Europe has similar levels of debt to America. But it got something for it. It built these social contracts. It invested that money. And turned it into high speed trains, universities, schools, hospitals, retirement systems, and much more, right down to super high standards for basics like food and water. So while Europe, yes, is in debt too, Europeans enjoy all these things, which lead to vastly higher living standards than in America — the highest in the world, and in history, in fact.

America didn’t do that. It didn’t go into debt by investing in grand systems of public goods. It didn’t take that money, and use it to build high speed transport, affordable education for all, universal healthcare, good media, retirement systems, and so on. It didn’t do any of that, in fact. And so today Americans don’t have a functional social contract.

Do you see the difference? It couldn’t be starker, really. Two nations, two regions, with the same debt levels. But in one, that debt wasn’t put to productive use. There’s nothing to show for it, really. In the other, while debt levels are becoming a problem, at least there’s something to show for it.

Keep reading with a 7-day free trial

Subscribe to HAVENS to keep reading this post and get 7 days of free access to the full post archives.