The Doom Loop That’s Destroying Our Civilization

(Why) Our Economies Are Trapped in an Arms Race They Can’t Win

Take a hard look at our economies. What do you see? Here’s what I see: they’re trapped in an arms race they can’t win. What do I mean by that? Another month — another brutal round of interest rate rises. Don’t worry — this isn’t just going to be about that, dry finance. It’s going to be about the future of our civilization, and if we have one.

So there go central banks, hammering up interest rates month after month. This is to stop skyrocketing inflation. But it isn’t. This approach isn’t working, and by now, we have not just one kind of proof, but three. Inflation goes right onsoaring. Meanwhile, banks have started to fail, because of course, higher interest rates mean more risk. And at the same time, real incomes are falling. It’s not working.

We are now trapped in an arms race of old-school economics. The theory goes like this. Prices rise, raise interest rates. The idea is that by raising interest rates, people will have less to spend — mostly frivolously. Inflation will grind to a halt. Presto, job done. Only, like I said, this isn’t working. The reason for that is very simple. This theory is about demand-led inflation: people having too much money, and madly bidding up prices. LOL — see anyone with too much money apart from billionaires?

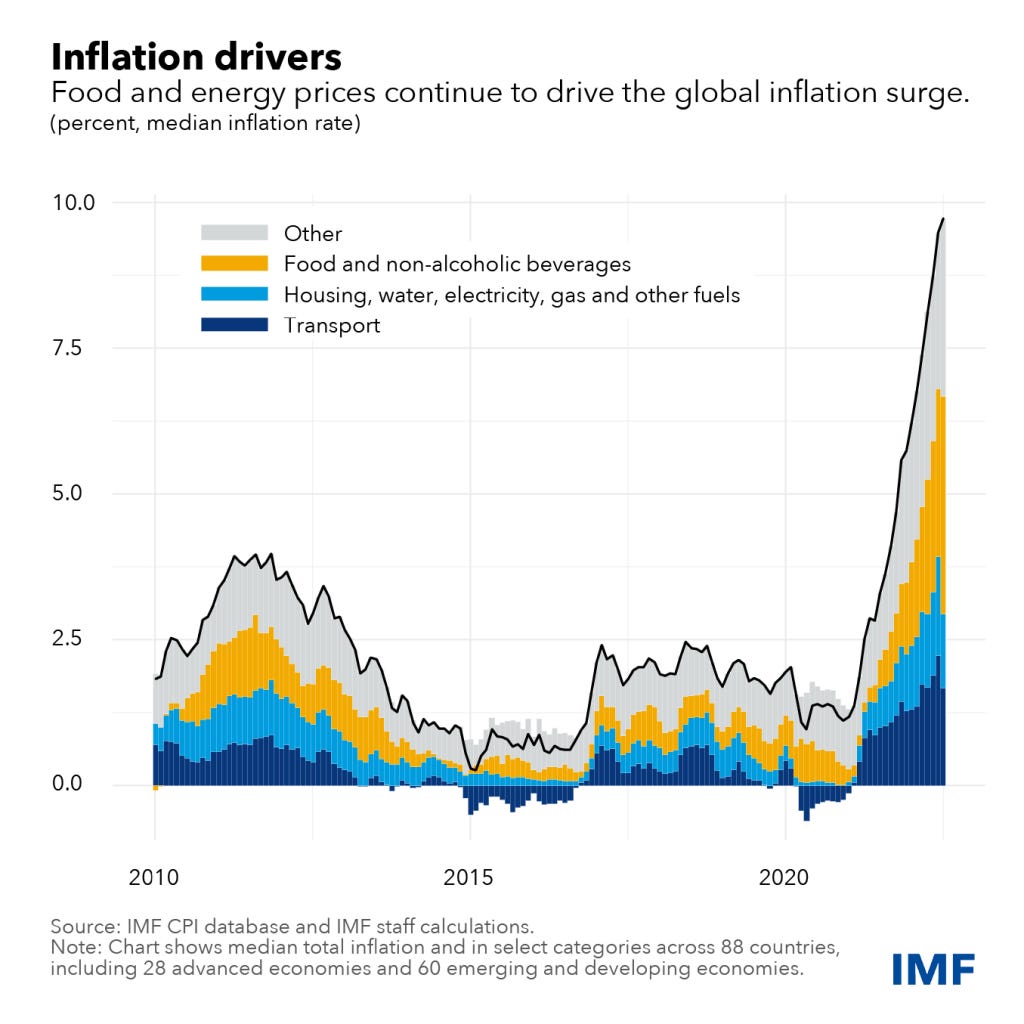

This theory doesn’t work when it comes to supply-driven inflation. And that is what we are facing now. It’s why this approach isn’t working. Now, some of you have heard me bang this drum before — but I want you to consider how much worse the situation’s gotten just in the last few months, let alone years.

What’s causing inflation? We used to think it was Covid. But societies aren’t locked down anymore, so it can’t be that. We used to think it was Covid aid, but that’s long gone, so it can’t be that, either. The answer is hidden in plain sight — we’ve hit the planet’s limits, in incredibly dire and serious ways.

Now, when I began to raise all this, you might have thought that I was talking about the future. But it turns out that I’m talking about now. What’s changed since the last time we discussed all this — which wasn’t even that long ago? The world’s first global water report was issued, and it concluded that — gulp — we’re running out of water. Supply’s going to exceed demand by 40% in…seven years. The UN issued its “final warning” on climate change, which said we’re going to hit the old target of 1.5 degrees Celsius, and blow past it, in the next decade. Momentous, dire consequences are unfolding.

And those who manage our economies are doing so like it’s the Industrial Age. You see, think about the distinction between supply and demand led inflation. What’s been true since the dawn of the Industrial Age, more or less? We haven’t had a really grave demand shock. A few tremors, maybe — the oil crisis of the 70s comes to mind. But since then, most inflationary bouts have been about demand, precisely because we were able to take supply — as in the planet’s ability to supply basics like water, food, air, energy, all that’s made from them, which is everything, really…for granted. So economics of the old-school kind doesn’t really see the world in any other way than “inflation? People must have too much money! It’s a demand issue! Quick, crush demand!”

Which is what raising interest rates does. But what if the problem is on the supply side? Then what does raising interest rates do? Well, by now you know, because you’re living it. Most people are struggling with bills right now, as prices soar, and then on top of that, the cost of servicing all the debt you’ve taken on just to have a life begins to rise dramatically. Your credit card payments, car payments, mortgage, student debt, “medical debt,” and so forth. Now you’re in the pincers of a trap — both costs of good and debt, aka interest, are rising, leaving you even worse off.

Keep reading with a 7-day free trial

Subscribe to HAVENS to keep reading this post and get 7 days of free access to the full post archives.