Should You Be Investing in...Silver?

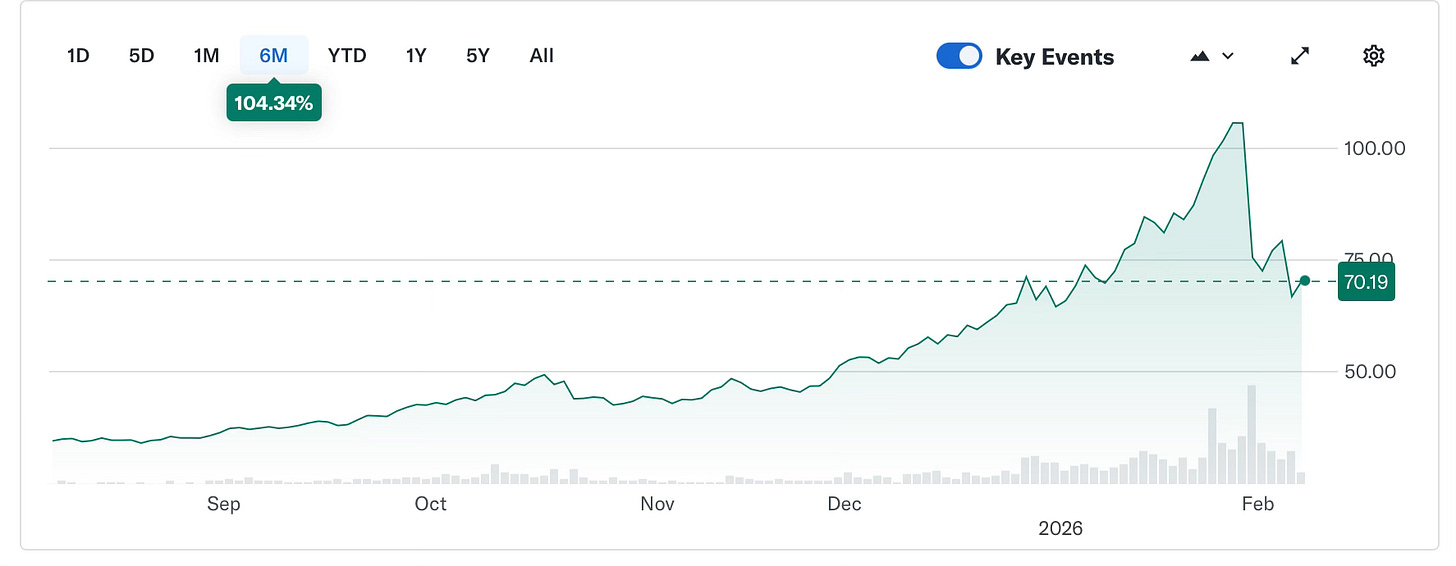

Silver’s taken everyone on a roller-coaster ride over the last few weeks. It soared to record highs, astounding everyone, fueling a kind of mania (hence this post, many, many people blew up my phone asking if they should "buy silver!!”). Then it crashed, and now, finally, it’s rebounded.

Whew.

If you bought into all this, your nerves are probably shredded. But the good news is: you learned something. Meanwhile, a lot of you are new to investing wisely yourselves. And even more than that, new to investing in something like silver. So here are some tips and ground rules.

Silver’s volatile. Much more so than gold. A bounce of 10% up or down or both over 24 hours isn’t unusual for silver. So if you’re going to buy it, then you need to expect volatility. Don’t be freaked out by it—it’s the nature of the beast.

Silver’s volatility has to do with a few things. Markets for it are spread out around the world, it has industrial uses, and historically, it’s been a small, thin asset class, meaning that it can swing wildly even if relatively small numbers of transactions take place.

But most of all, it’s volatile because…

Silver’s not gold. It’s often said to be the poor man’s gold, and that’s been true in a historical sense, if you mean coins from empires bygone were minted from it. But it’s not true in a modern monetary sense. Central banks hold gold reserves, but not silver reserves. Gold is a part of the modern financial system that silver isn’t.

So silver has to be understood for what it is. Not quite the poor man’s gold anymore—now, something more like what we might call a Secondary Haven. As in, my second favorite pair of combat boots, maybe.

Over the last year, silver’s been trying to prove itself as a true haven. It’s just now beginning to emerge as one, perhaps. For that to truly be the case, silver would need to exhibit less volatility, and be a more reliable store of value. And we’ll see if that happens. It could and it should, I think, as markets for silver expand, as more people hold silver as a long-term asset, which will inherently make it less volatile. So: silver is beginning to exhibit a Havens Effect.

Yet at the same time, what happened over the last month was that silver’s Haven Effect was outstripped by a clear, sudden, dramatic speculative effect. That’s what produced the immense, rapid spike in the chart—a visible bubble.

We don’t want Havens to be speculative vehicles. We just want them to protect us from Macro Risk. And so in silver’s case, this contest between its Havens Effect and its speculative effect will continue well into the future, over the next 2-5 year time horizon. That means that it’ll continue to be a bit of a nerve-shredding thing to hold.

Where does that leave us? I have four conclusions.

—Where silver’s settled, about $70, is about the correct value for it at the moment. That’s why the market rebounded precisely at that number. (We can infer this value from the historical price of other kinds of assets, by the way.) —I’d expect it to rise over the coming year. And we’ll see if it gets less volatile as it does. It sold off dramatically, by the way, in part because of China, and in part because of Bitcoin’s crash, and that too has lessons for how much of a Havens Effect silver has, and has yet to have.

—Right now, silver’s probably more risky than I’d like. It offers nice returns, yes, but if you have nerves of steel, and you understand where it’s well valued. If you buy into bubbles and manias, and pay too much for it, then you’ll get burned.

—Silver has a place in the modern financial portfolio. Right now, it’s a relatively small one. That amount will grow over time, as it emerges as more of a foundational Haven.

So. If your nerves did get shredded by silver’s meteoric rise and fall, congratulations. Go ahead and chuckle. You underwent a trial by fire. And you learned where investing well begins, in an era like this: finding Havens, as the world continues to unravel.

Lots of love,

Umair (and Snowy!)

I bought a bunch of silver coins ten years ago, put them in a safe deposit box, and basically forgot about them. They are bulky and heavy to move. If I move overseas, I don’t know where I would store them.

I sold off my little stash of gold coins 3 years ago to rid myself of the debt I had assumed for Joe’s hospitalization in Panama. Grateful I had them for this moment. Grateful to be debt-free.

I'll not reveal my position, but I'm not worried about this week's dramatic moves. I hold it as a last-ditch hedge. And if you don't hold it, you don't own it. The moves in ETFs proves the rule.