HOW IS HAVENS DOING SO FAR IN 2026?

OR, HAVENS IS DOING VERY WELL, PLUS A LITTLE REVIEW AND DISCUSSION

How’s Havens doing so far in 2026? Pretty well, to put it mildly.

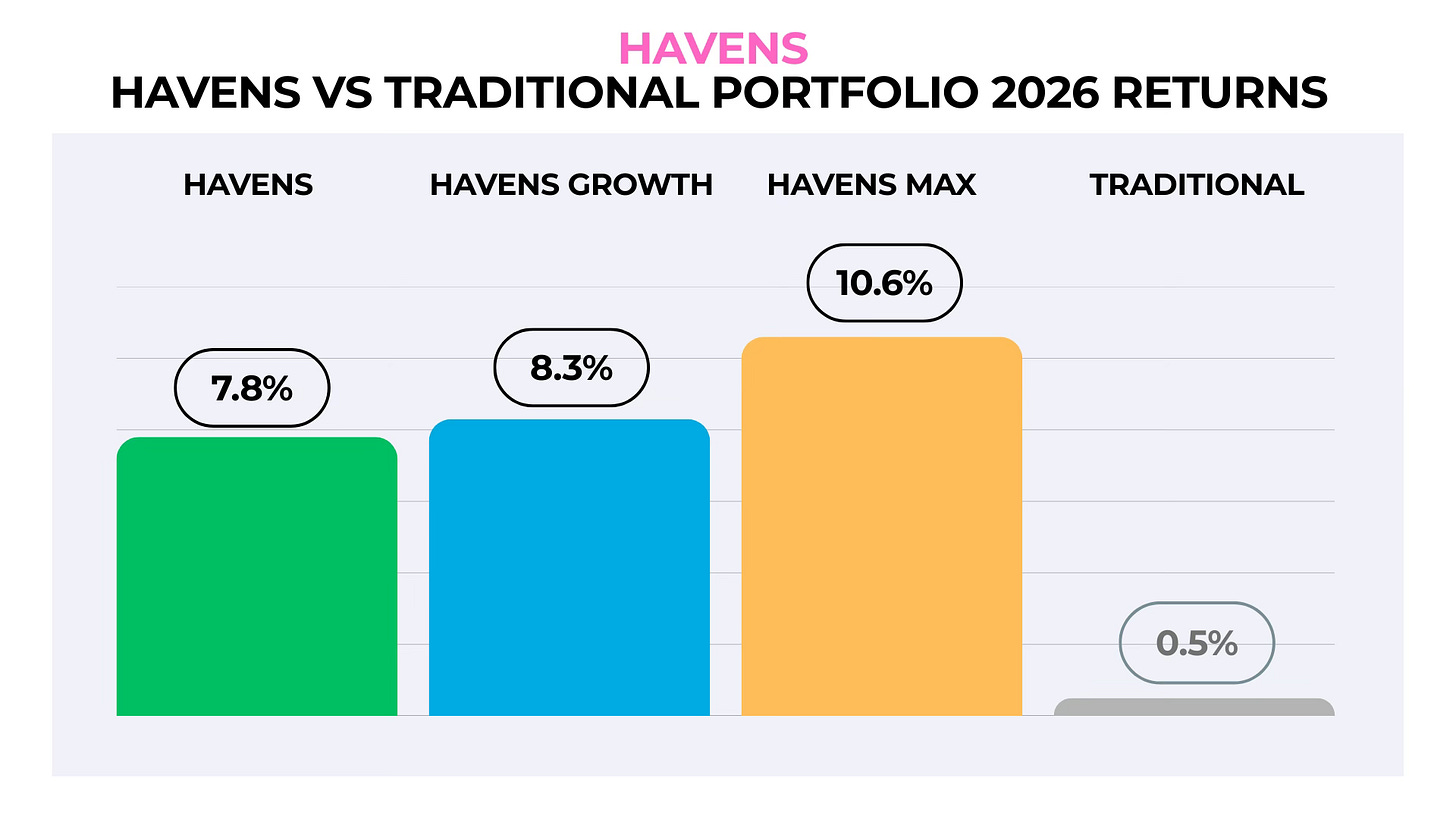

Here’s a little performance review for the year so far, summarized in the chart above. There are three Model Portfolios in Havens, and so far:

The Standard Havens Portfolio is up 7.8%.

Havens Growth is up 8.3%.

Havens Max is up 10.6%.

While the traditional 60/40 portfolio is effectively flat.

Those are excellent returns—remember, this is for the year to date, 2026, which has barely begun. To put them in perspective, the standard portfolio delivered between 9-10% all year in 2025. It’s just six weeks into 2026, and Havens is already rivaling or exceeding those. (To put it another way, Havens is delivering fifteen to twenty times the returns of the standard portfolio, which is barely delivering any so far in 2026. That’s a lot!)

I’m happy to see Havens performing so explosively well. These returns are continued evidence of the Havens Thesis at work—in a troubled world, there will be a flight towards havens. It’s confirmation, too, of the thinking behind Havens—the Macro Risks that I discuss with you often are why the standard portfolio’s flat, for example, from Trump to AI and America collapsing and so on.

These results are vivid, striking, and impressive. It’s almost funny, in a way, to see that just a few weeks into 2026, Havens is hitting the level that the standard portfolio delivered in all of last year. Havens is doing what it was designed to do, which is perform at or above the world’s top investments. (Before you ask, yes, I’ve been there and done that, which is why I know how to do this.)

Havens continues to do this with ease, too, which is noteworthy—the portfolios haven’t been adjusted at all this year. That’s why I often say, when people ask me: “even I don’t mess with Havens much.” It was designed with love and care from the ground up to be powerful, to reinvent wealth in an age of disintegration. (You’re allowed to go ahead and LOL with me at how well it’s doing it so far if you want to.)

A note of caution. It’s easy to look at numbers like the above, and extrapolate. If Havens is up 8-10% in the first few weeks of the year, does that mean it’s annual returns, are going to be…100%+? No. I want to caution against this kind of thinking. It’s more probable that Havens will have down months this year, too, and this excellent performance will come back down to earth a bit. Don’t be surprised if that happens—in fact, if this stellar performance continues all year, even I’d scratch my head a bit. (If anything, seeing numbers like this gives me a note of pause.)

I’m proud of the performance above, too, by the way. A lot has happened in the last six weeks, and none of it’s been good. Crypto crashed spectacularly. AI’s ripped apart sectors of the American stock market. America’s debt continue to skate on thin ice. Gold and silver had an historic meltdown. And yet there’s Havens, powering ahead. To show this kind of strong performance over a period of such sustained pessimism, chaos, and crash after crash in market after market is, to my mind, an accomplishment.

My target for Havens is relatively modest. If it hits 20-30% annual returns, those are adequate. Even that is double the average hedge fund return. It appears that we’re on track to hit those numbers soon enough, which is pleasant to see, and faintly funny, too. We’ll see how Havens continues to grow and evolve. For now, I’m happy with the performance above, and I hope that you are too.

I’ll publish these reviews for you perhaps monthly or quarterly. You can let me know how often you’d like them, and if they help. Of course, if you’re new to Havens, you won’t have achieved the numbers above yet—but those of you who’ve been using Havens for some time now should.

(And of course, everyone’s numbers will differ, because Havens doesn’t control your money, you do. These results are here for reference, to show you what you “could” or “should” be achieving.)

All of this is here to teach and guide you.

Thank you to everyone who’s joined Havens so far.

Love,

Umair (and Snowy!)

Umair, I’m a Havens member. My wife & I had a session with you last April. We paid off our mortgage last week. Thank you for encouraging that.

But, how do I view the portfolio?

Less about earnings, I want to cut ties with the smoke & mirrors folk.

We also want to have dollars invested in ethical product.

Congratulations on the model’s performance. Bless you, Jim

Two questions if you please. One, would now be a good time to invest a lump sum I have sitting in Swiss Francs (thanks for that tip!)? Valuations seem high for many things, especially precious metals. Two, please do design an investment income version. Much appreciated and keep up the great work. This has become my favorite substack!