Are We in Another Banking Crisis?

What Happens When You Don’t Build a 21st Century Economy? This Does

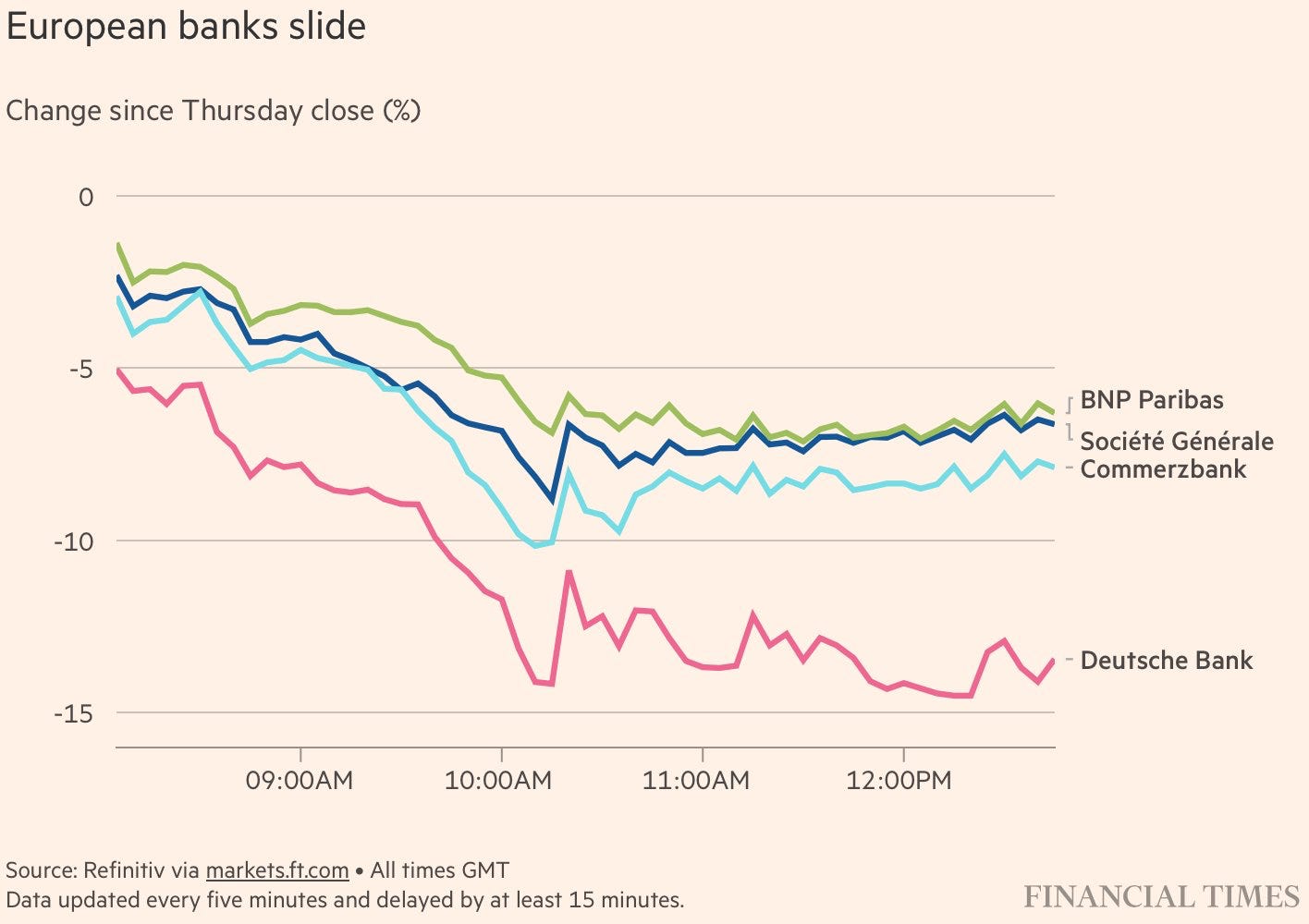

By now, you can see: it’s not over. What began with Silicon Valley Bank and Credit Suisse is still intensifying. “Jitters,” as they say, are racing through the financial system. What’s all this really about? Why, suddenly, do we seem to be poised on the edge of a banking crisis — out of the blue?

Polycrisis. It’s a word we should all know. The world emerges from a pandemic — and plunges straight into a banking crisis. And you’re quite right to remonstrate that, no, Covid’s not “over” — we just pretend as if it is. We race from, it seems, one crisis to the next. Why? What’s going wrong?

Let me answer the question that’s probably on your mind. Are we headed for another banking crisis? Yes, most likely, we are. It’s inevitable, in fact, just a matter of time. Not in the usual sense — cyclically. But in a secular sense. We are headed for the mother of all financial crises — and I want to explain in a little more detail just why. If you want the summary now, it’s about the end of the Industrial Age, and the Dawn of the Age of Extinction, or, in a less accurate sense, “climate change.”

Our financial system isn’t fit for this century, and until it is, it’s going to be hit by intensifying crisis — just like the rest of our systems, from food to water to energy to healthcare. What do I mean by that?

There are two kinds of banks. Retail banks and investment banks. Retail banks hold your deposits and lend to households. Investment banks…invest, or at least so the theory goes.

How is this financial system coping with…the Age of Extinction? It’s not.

Now. What’s going on in the economy? Well, prices have soared, and real incomes have fallen. People have gone further and further into debt. Meanwhile central banks keep on raising rates, to try and tamp down prices, but it’s not working, precisely because it’s not about too much demand, but too little supply — the world’s running out of water, food, energy, our planet unable to supply us with the basics at the old levels. So we can see, easily, that a certain chain of consequences is likely to ensue. Price go on rising — do you think the planet’s going to magically spirit up more water, clean air, food? People can’t make ends meet. Interest rates keep on rising. Plenty of the debts people are in just to make ends meet they’re in go bad. Bang. Banking crisis.

The precise mechanism doesn’t matter so much. Is it mortgages people can’t pay? Credit cards? Car payments? All of the above? Our financial systems is a maze of “derivatives” — secondary bets — on various forms of debt. What matters more than the precise form of trouble is understanding the point: risk is now accumulating in the system that it can’t handle. People are stretched to the limit already, but prices are only going to rise, and so are interest rates, and that means that almost certainly banks will be hit by waves of bad debt.

Let’s zoom out for a second and think now not like bankers, but economists. What’s happening here at a macro level? Living standards rose for centuries, after the Big Bang of the Industrial Revolution — but that ascent has now come to a halt. Not my opinion, empirical fact. Living standards have fallen in 90% of countries. Now we are in a new and very different economic age. To maintain the same living standards as we took for granted during the Industrial Age, we will have to pay more and more, because scarcity is the great trend of now. Having hit the planet’s limits, every drop of water, meal, joule of energy, and so forth, will cost more and more — at least until we reinvent our basic systems for them. Those systems are still — all of them — Industrial Age ones. They were not meant to cope with scarcity, and now that limits have been hit, planetary ones, they can’t provide the same level of abundance. Do you see how different the economics of the Age of Extinction and the Age of Industry really are?

In this gap there’s all but certain to be the mother of all financial crises. Because our Industrial Age economies cannot provide the same living standards as we took — and take — for granted, except at higher and higher prices, which, of course, mean everything from bad debt to bankruptcy to interest, all of which have to be absorbed by banks, and will inevitably crush some, perhaps many.

Now. The key phrase in all the above was: “until we reinvent our systems.” Prices will just keep rising. For everything — food, energy, water, healthcare, etcetera. How much more are you paying for all these things already? I’m sure you’re feeling the pinch — we all are. This is what falling real incomes means. Our living standards are now declining as a civilization, and another way to say that is: what we once took for granted is becoming unaffordable. Until we reinvent our systems.

Keep reading with a 7-day free trial

Subscribe to HAVENS to keep reading this post and get 7 days of free access to the full post archives.