Are We in a New Economic Lost Decade?

Hello, What Did You Think “Age of Extinction” Meant?

“Something is going to go boom.”

That’s how Kristalina Georgieva, the IMF’s Managing Director, put it, when discussing the state of the global economy.

So make it official. Just last week, the World Bank issued a report which everyone should know about — but few do. That report warned, in no uncertain terms, of a lost decade. For the world. It was entitled, grimly enough, “Failing Long-Term Growth Prospects.” Now, there are reports, and there are reports. By institutions — and institutions. This one? It’s a warning to our civilization. It is saying, effectively, what I do: we’re almost in the mid 2020’s, and ours is a portrait of a civilization in profound crisis.

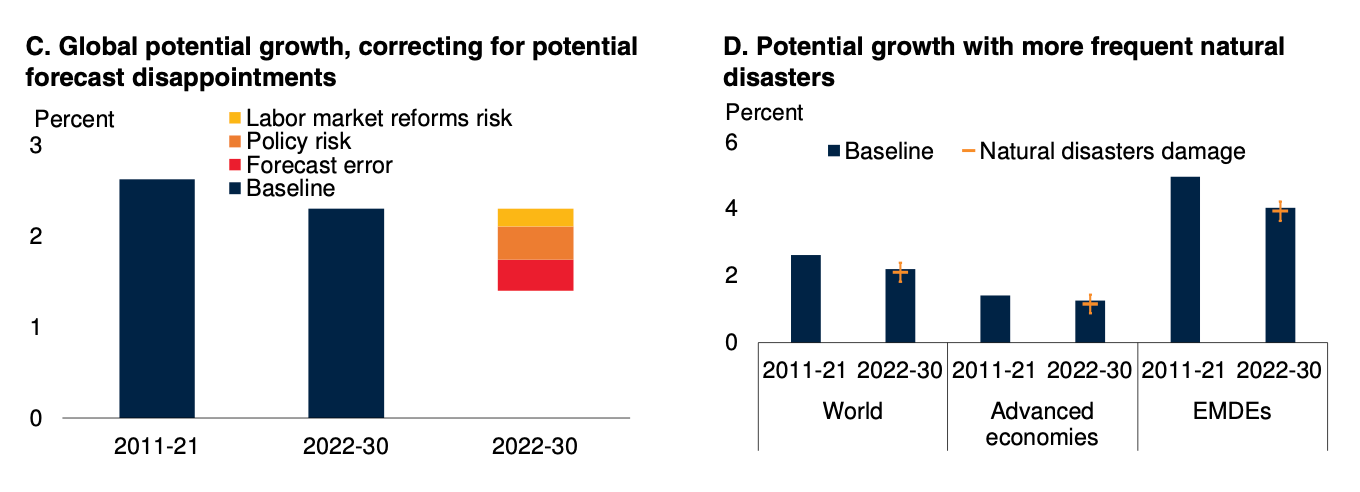

Here’s how the report opens. “Across the world, a structural growth slowdown is underway: at current trends, the global potential growth rate — the maximum rate at which an economy can grow without igniting inflation — is expected to fall to a three-decade low over the remainder of the 2020s.” That’s… well, pretty bad. And if anything, they’re understating the case. Let’s keep going, though, for a second. Why do we face a lost decade?

Nearly all the forces that have powered growth and prosperity since the early 1990s have weakened, not solely because of a series of shocks to the global economy over the past three years. The growth rates of investment and total factor productivity are declining. The global labor force is aging — and expanding more slowly. International trade growth is much weaker now than it was in the early 2000s. The slowdown could be even more pronounced if financial crises erupt in major economies and spread to other countries as these types of episodes often lead to lasting damage to potential growth.

OK. Let’s take those one by one, so I can begin explaining to you what’s really at stake here. The Bank doesn’t call all the above “civilizational risk” — but it should.

Our global economy now has a missing engine. “All the forces that have powered growth since the early 1990s have weakened.” What does that mean? Well, what powered rising levels of prosperity? Growth in international trade, and technology — information technology. But now? Our situation’s very, very different. The way that we designed the last era of international trade has had a backlash — working classes in rich countries, who didn’t do well out of it, are giving up on democracy. Hence, the rise of the global fascist wave of now. Trumpism is the canonical example — but it’s also what happens when a global economy has a missing growth engine, because when people have nothing much to do, except despair, stew in fury, rot in rage, then of course they’re easy prey for demagogues.

What’s the great technology of now? Well, AI’s emerging. But it’s economic effects are going to be, to put mildly, disastrous. Unlike the last wave of info-tech, which let us accomplish tasks with a click, and arguably made the economy more efficient, AI’s effects are going to be weird, creepy, and ruinous. It’s going to basically cause a supply shock — a dramatic oversupply. Of what? Of all kinds of “content,” as we call it today. We used to call it “user-generated content,” what makes up most of the internet, but soon, it’ll be AI-generated content. Shudder. That’s going to devalue lots of people’s livings. Especially in the arts, in journalism, in creative fields.

It’s not that AI can write a cracking novel or a great song — it’s that the average person probably doesn’t care. Weary, depressed, you can see visibly that most people just want to tune out, no matter how low the quality of media is — hence, the rise of Netflix and Amazon as media giants. AI will finish the job of the race to the bottom, and carve a gaping hole in our economies as it does so.

Sure, there will be gains here and there — AI assisted surgeries perhaps, manufacturing advances, and so on. But the point is this. Our economy now doesn’t have a growth engine. And that is very, very bad news, in a world already turning swiftly anti-democratic, precisely because the last era of trade didn’t really lift the living standards of the working class in many places nearly as much as was promised.

It’s one thing to have a missing growth engine. It’s another to have a…house on fire. That brings us to climate change. What’s its effects on the economy? You’re already living them. Inflation, of an especially ruinous kind. Prices just keep on climbing. Corporations profiteer, adding to the burden, because, well, they can. Central banks, baffled by all this, their mindsets designed for the Industrial Age, only make the situation worse, by hammering home rising interest rates, all of which…accomplish nothing positive or constructive to solve the problem. It’s not as if a higher interest rate plants a tree or replenishes a river, after all.

Climate change’s economic effects are already upon us, and they’re ruinous. We haven’t quite connected the dots yet, because, well, we don’t want to. But some smarter minds are beginning to. Partha Dasgupta, one of the great economists of this century, is worth reading, eminently so. On the scale of everyday life, though, just ask yourself: how much longer can people take this pain?

People are already going into higher and higher levels of debt — record levels, in fact — to make ends meet. People aren’t taking on mountains of debt to buy luxury sky vacations — just to feed their families and pay the bills. Hence, the rise of buy now, pay later schemes — to fund the basics. These are dire, dire indicators, because they bring us to the Bank’s next point.

The slowdown could be even more pronounced if financial crises erupt in major economies and spread to other countries as these types of episodes often lead to lasting damage to potential growth.

How would that happen? Well, while this seems complicated, it’s actually devastatingly simple. People reach a point where they have been pushed too far. They can’t afford it anymore — basics, bills, interest. They begin to default — and by the way, delinquency rates are already creeping up — on all that debt they’ve piled up just to make ends meet. As that tipping point is hit, what happens? Financial crisis does.

Keep reading with a 7-day free trial

Subscribe to HAVENS to keep reading this post and get 7 days of free access to the full post archives.